A look at Pelham taxes compared to our neighbours

As the weather cools and the days get shorter, Town administration and Town Council must necessarily turn their minds to next year’s budget. The budget is the single most important document created by the municipality in any given year. It is Pelham’s financial roadmap for the year ahead, clearly indicating the Town’s priorities. The budget basically breaks down into monies that will be spent on big things such as road repairs (“capital budget”) and money spent on things such as salaries for the people who patch the roads (“operating budget”).

When looked at as a whole, it would be reasonable to suggest that the Town of Pelham has slightly below average property taxes, low reserves (not much money in the bank) and relatively high debt (primarily to pay for the MCC). Any potential tax increase that results from the upcoming budget deliberations will be used to finance municipal operations (inflation is up across the board) and also provide the means to partially replenish reserves and/or meet debt obligations. All of this occurs in the context of increasing demand, strong population growth, high inflation, but also a need to respect the taxpayer’s ability to pay.

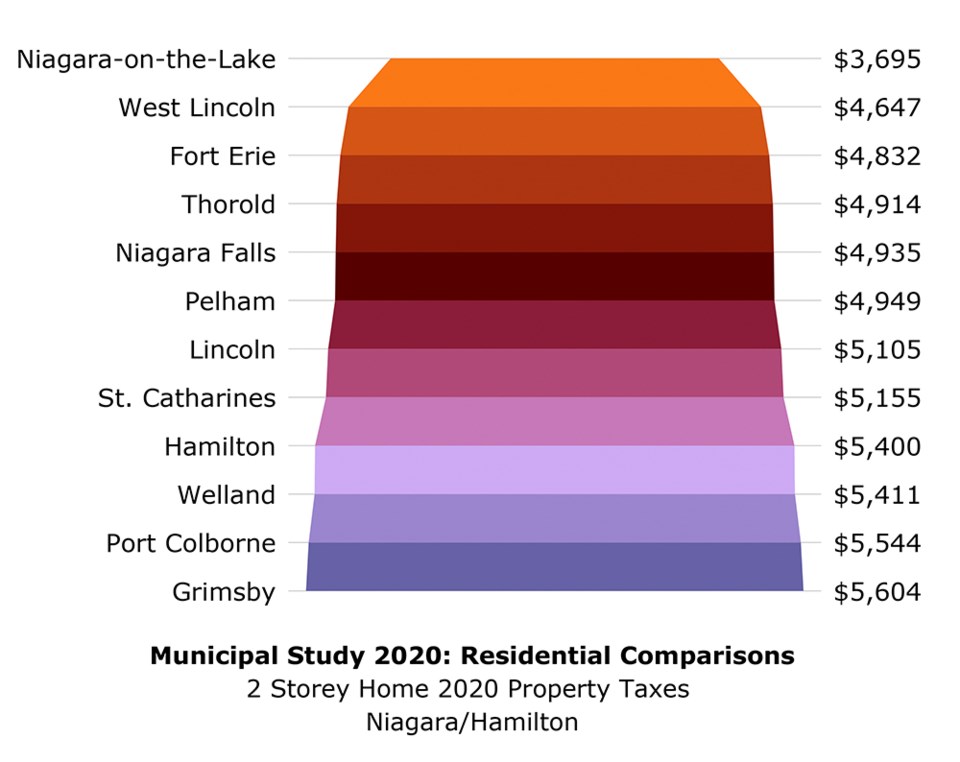

The budget ultimately determines how much each property owner must pay in property tax. Like other municipalities, Pelham applies higher rates of taxation to commercial, industrial and institutional properties so as to reduce the burden upon residential properties. Recently, there has been some suggestion that the Town’s tax rates are too high. While the question of what is “too high” will vary from person to person (and let’s face it: no one likes paying taxes), it is accurate to say that Pelham’s tax rates are below the Niagara median — they are below average, and that is true for both expensive and for more modest homes. As you can see from the table above, which was created by a highly reputable municipal consulting firm, in 2020 Niagara’s average property taxes were as shown, for a typical two-storey home.

In the months to come there will probably be plenty of public dialogue around tax rates, debt levels, the state of the reserves and other issues that directly or indirectly influence municipal taxation, particularly as we head towards next year’s election period.

It is for the community, through its elected officials, to determine what constitutes “too high," “too low,” or “just right” for property taxes. Senior staff and I would suggest that Pelham occupies an enviable space in that its tax rate is below the median, but the service provision is on the high end (compare Pelham’s sidewalks to those in Thorold, or Pelham’s MCC to Welland’s tired facilities). The gap between paying below-average taxes and receiving above-average service is the Town’s value proposition to its residents.

What staff can say is that the Town’s taxation is in line relative to eleven Niagara comparators, and that in fact that there is a fairly good value proposition being provided in return for property taxes. Other Niagara municipalities are looking at very modest tax increases for 2022, however they are starting from a much higher level of taxation per capita, and so should be able to afford to do so.

It’s hard to love paying property tax, but perhaps knowing that Pelham’s rates are below average, while the quality of life is high, can help all residents feel a bit better when they make their payments. Council and staff will continue striving to provide value for your money. ◆